Objective

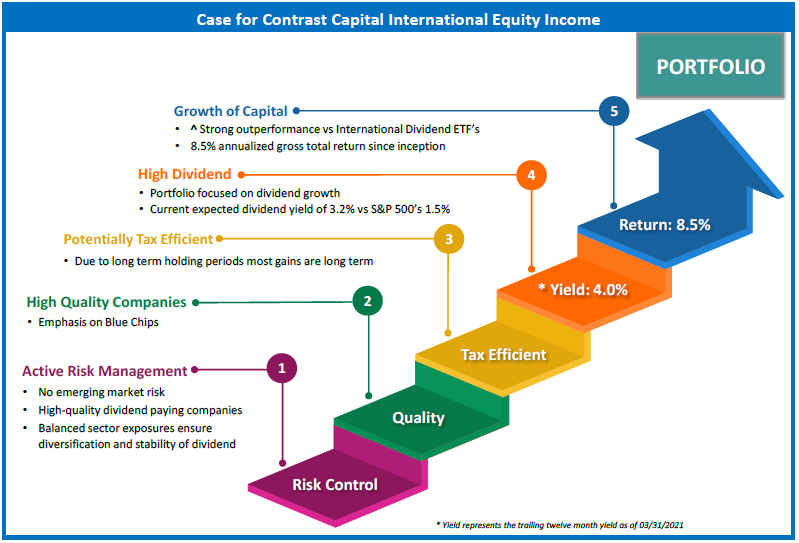

We believe that investing in high quality international blue chips with strong cash flow sustainability, solid dividend growth and attractive valuation will produce a superior investment portfolio. We believe that these stock characteristics, coupled with portfolio construction with balanced exposures, will produce high portfolio consistency and superior long-term returns to investors.

Strategy and Process

Highlights

- Blue Chip exposure in developed international equity markets

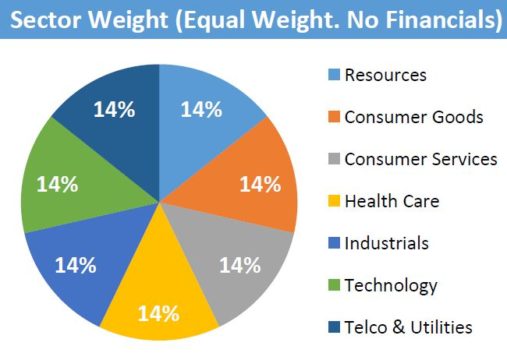

- Balanced portfolio weights – provides wide exposures and more balanced risks

- Higher yield – strategy yields above 4.0%

- Low trading costs due to limited number of trades per year and use of ADRs/US listings

- Superior returns and risk metrics – compares favorably to ETF’s, active funds and benchmarks.

- Tax efficient due to (i) low trading vs active funds and ETF’s, (ii) separate account format and (iii) long-term orientation

If you would like to learn more about the Contrast Capital International Equity Income Strategy, please provide us your contact details here