Objective

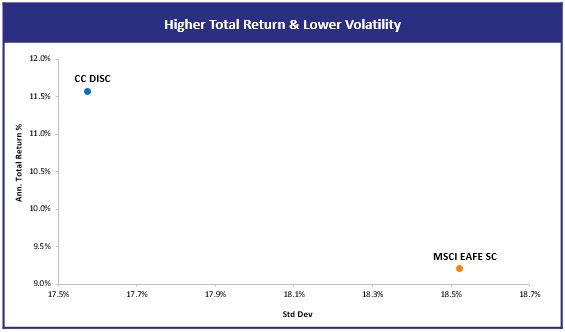

We believe that investing in high quality international small caps with strong cash flow sustainability, wide EBITDA margins and attractive valuation will produce a superior investment portfolio. We believe that these stock characteristics, coupled with portfolio construction using balanced exposures, will produce high portfolio consistency and superior long-term returns. We seek to construct a balanced portfolio of high quality international small cap stocks that deliver superior long-term returns.

Strategy and Process

Highlights

- Relative to the benchmark the portfolio exhibits:

- Strong Balance Sheets

- Higher Absolute Dividend

- Higher Margins

- Stronger Cash Flow

- Beta of 0.89 since inception

If you would like to learn more about the Contrast Capital Diversified International Small cap Strategy, please provide us your contact details here